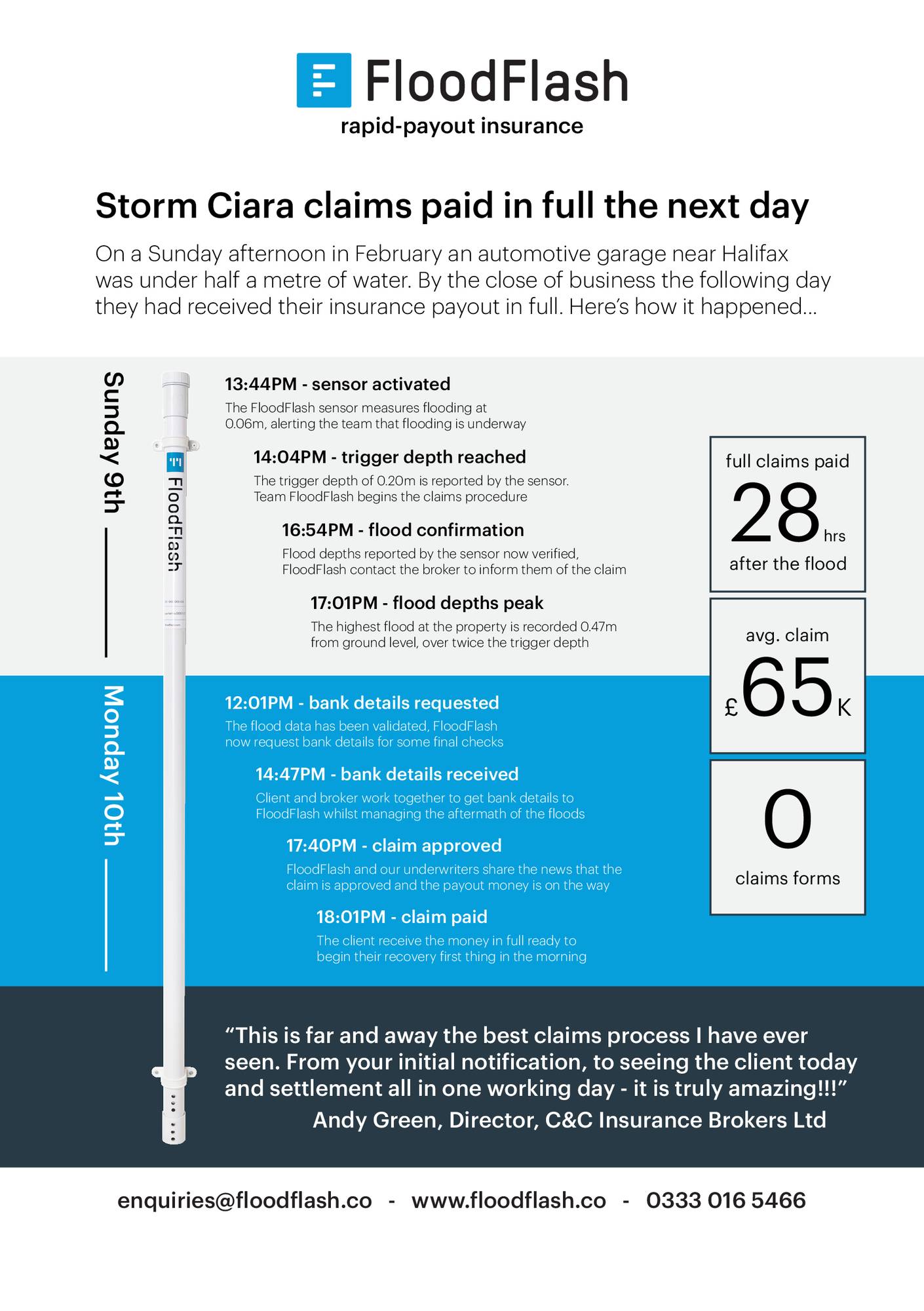

FloodFlash offers the first parametric flood insurance product aimed at businesses and property owners. A FloodFlash policy pays a fixed sum as soon as flood water reaches a pre-agreed depth.

Verified partner

Contacts

Ola Jacob Raji

floodflash.co

Account Executive

United Kingdom

Anna Goeckemeyer

Hannover Re

Solution expert

Melanie Schlie

Hannover Re

Solution expert

Responsible for this content

floodflash.co

United Kingdom

worldwide

Views: 12593

Downloads: 2587

Page is favored by 4 user.

Contact inquiries: 3

Disclaimer

External vendor partners can provide content on hr | equarium. Hannover Rück SE does not verify these contents. Hannover Rück SE is also not responsible and not liable for the contents and services offered. For more information please see the terms of use.