The genius of embedded insurance

Embedded insurance offers an alternative route for distribution and sales. Lorenz Kemper of Hannover Re and Darcy Shapiro of Cover Genius explain its origins and how it’s evolving.

Embedded insurance is a business model with a long pedigree. Just think of bancassurance, the practice of selling insurance policies through banks, which began in the 1970s. However, the idea of distributing insurance products through another business, as part of a bundled service, has really taken off thanks to the e-commerce and m-commerce revolutions. If you’re buying something online, and you need insurance as well, why not do everything in one go?

“The digital economy is the perfect catalyst for embedded insurance,” says Lorenz Kemper, Digital Business Accelerator at Hannover Re. “It’s a B2B2C model that reverses the principle that ‘insurance is sold, not bought’, because it enables people to choose an insurance product to go with another product that they are buying. For example, if you buy a holiday or a consumer item, you can embed insurance as part of the purchase at the point of sale.”

Customer focus and streamlined cover

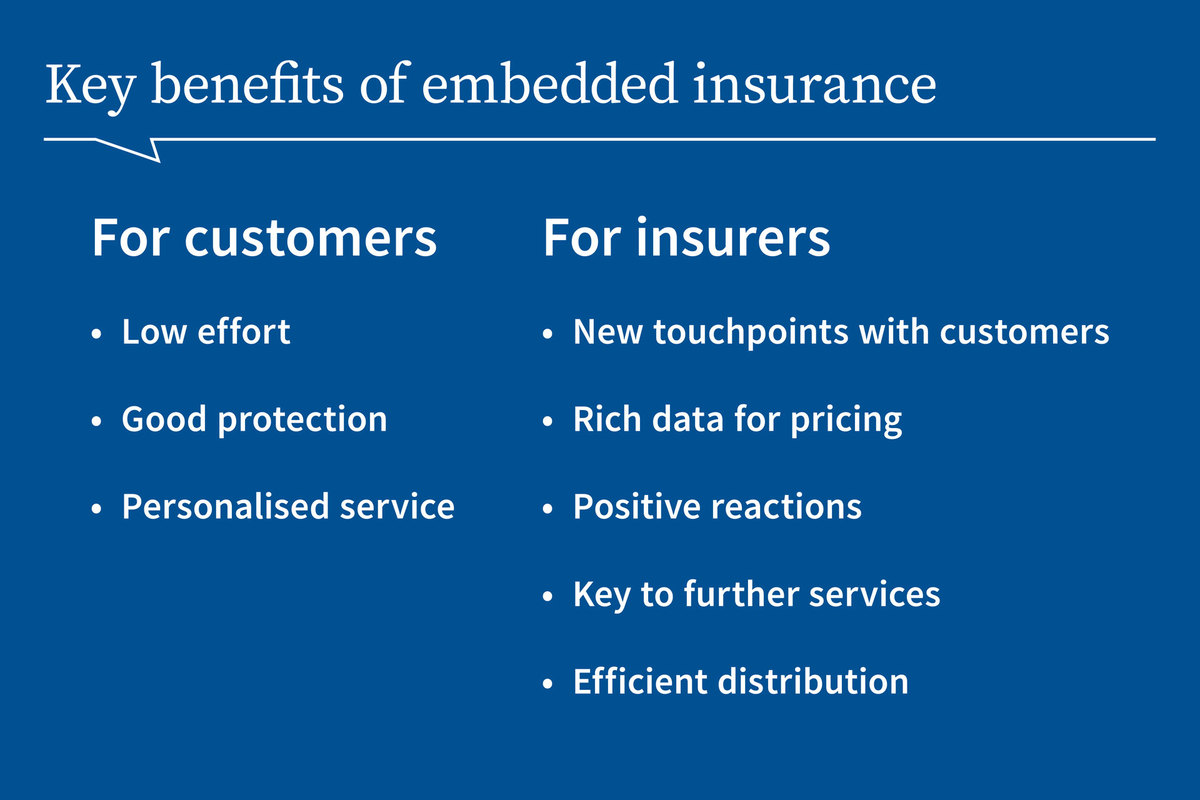

Kemper says that embedded insurance means consumers no longer have to buy policies as a standalone second step, which suits today’s digital-first consumers and means they receive the cover they need, at the most convenient time. And for insurers, who traditionally rely on intermediaries such as brokers and advertisers, it’s a new route to market that simplifies and streamlines the way they connect with potential customers.

Embedded insurance blends the latest technology with insurance products, so that businesses can make insurance part of their infrastructures. There are now many technology providers and platforms that can support the embedded model. Cover Genius is one of the fastest-growing brands to have emerged in this space.

End-to-end insurance

Supporting a wide range of products across numerous industries, Cover Genius typifies the integrated approach that has developed in response to digital transformation and, latterly, the impact of Covid-19.

“Thanks to digital technology, you can embed insurance across many different verticals,” says Darcy Shapiro, COO Americas at Cover Genius. “Covid of course moved everything further online, and because connected technology and ecosystems are fundamental for business today, and protecting consumer purchases and experiences is more relevant than ever, it makes sense for insurance to be integrated wherever possible.”

As well as bancassurance, travel proved an early use case for embedded insurance because travel and insurance are a natural fit and online travel platforms have mushroomed in recent years.

“Today’s consumers want protection that is straightforward and easy to access, and they want it online from their favourite brands,” says Shapiro. “We help consumers receive tailored offers, relevant to their purchases, right at the point of sale or sign-up.”

The technology that makes this possible is a global distribution platform called XCover. As Shapiro explains, this is built on a REST API that dynamically optimises prices and products in real-time, bundling policies from any category and underwriter. This enables Cover Genius to provide relevant policies in any country and language.

REST stands for representational state transfer and is a software architecture that dictates how the application programming interface (API) should function. The API works behind the scenes to connect services, and it enables quotes from many different providers to be displayed on a third-party platform. REST facilitates software integration and promotes flexibility.

“Through XCover, we enable our partners to offer and embed any line of insurance or warranty product at the point of sale or purchase with a single API call,” says Shapiro. “XCover is an end-to-end platform that can handle the whole process. From quote and bind to claims and payments, we can keep our partners’ customers at the centre of everything we do.”

Challenges and opportunities

Although rapid digitalisation is reinforcing the value of the embedded model, the most common applications currently relate to straightforward and less complex risks. But even where risks become more involved and challenging, the opportunity to embed is still compelling.

Shapiro says that as the model matures, so will the capability of embedded insurance to handle all types of risk. “At the moment, one of the key strengths of embedded insurance is that it solves check-box compliance requirements,” she says. “An example is platforms that require businesses to carry product liability insurance in order to sell on their platform. I believe that these types of business-enabling products paired with the simplicity of embedding insurance offerings will push the industry to embed more complex risk products and types of coverage.”

One perceived limitation or drawback of the embedded model is that it means insurers lose their direct relationships with customers because everything goes through an intermediary who gains customer loyalty instead of the insurer.

However, Shapiro doesn’t see it that way. “We see it as net-positive for our insurance partners. With embedded insurance, the insurer gets more of the pie even if there’s no direct relationship. Customer acquisition costs are huge, and the direct-to-consumer market also results in adverse risk selection. By contrast, the embedded model brings big savings in distribution costs for insurers, sells more policies and leads to better risk selection. That’s a powerful advantage.”

Cover Genius was launched as a full-stack insurance distribution platform in 2014, initially for mobility, retail, travel and shared economy partners in Europe. Since then, it has expanded its operations worldwide with licences or authorisations in more than 60 countries and all 50 US States. With the launch of its XCover platform in 2016, it added property, rental, landlords, commercial, shipping, cargo, and marine insurance to its business. In 2018 it launched XClaim, an API for instant claim payments. Cover Genius’s mission is to protect the customers of the world’s largest online companies.

Related solutions

End-to-end insurance protection through XCover

User questions

Answered questions

Unanswered questions

Views: 6829

Downloads: 0

| 100 % | |

| 0 % | |

| 0 % | |

| 0 % | |

| 0 % |

Page is favored by 0 user.

Contact inquiries: 0